Abstract

Belgian pork production has faced stagnating prices for decades. It remains unclear whether excessive market power from slaughterhouses or meat retailers has played a role in this trend. While market power studies can reveal some of the market dynamics in this setting, this type of research has not yet been applied to the Belgian pork market. The present paper investigates oligopolies and oligopsonies in the pork production sector. We build a new model that focuses on market power dynamics in the market for live pigs and distinguishes horizontal and vertical market power parameters, both for pig farmers and for slaughterhouses. The results follow from an empirical application using unique slaughterhouse data for 2001–2015. The results indicate that the farmers benefit from a significant power advantage in the live pig market, when very modest price demands are taken as a reference. The final market price of live pigs approaches the price requested by the farmers. On the other hand, the measured vertical market power also suggests that a pig farmer does not receive the (modest) full-wage-based salary. The market power of the slaughterhouses is also limited. Market power as a result of collusion—that is, horizontal market power—is present, but is not strong. However, there are significant differences between the slaughterhouses in terms of mark-up on the input prices. These differences reflect differences in company strategy, and this diversity further reduces the possibility to create sector-wide collusive behaviour.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In Belgium, prices for meat products have been stagnating for years. Both the animal-raising farms and the slaughterhouse sector have shown a low level of profitability. Studies at the start of this century showed that poverty was widely present among family farms in Belgium, and many did not earn more than a minimum wage (Van Hecke 2001). This situation has not improved in recent years, particularly for farms specialising in animal products. Official reports have been commissioned to review average farm profitability (Deuninck et al. 2009). Farms specialising in piglet breeding had negative income from 2006 to 2008 (FOD Economie 2010). In 2007 and 2008, negative income was present even before subtracting the annual farm’s household income. Farms specialising in pig fattening presented slightly better profitability and showed a small positive benefit during this period. However, profits remained under pressure from increasing fodder prices and decreasing prices for live pigs. A follow-up report showed that this situation again deteriorated during 2010–2012 (Vrints and Deuninck 2013).

Authorities are concerned that price transmission in the meat column in Belgium is not fully competitive. The National Price Observatory was asked to conduct several studies on the price and cost structure of the beef and pork production column (FOD Economie 2009, 2010). These studies were motivated by the difficult situation of the animal husbandry sectors. The reports highlighted the problems of price formation, showing that the obtained prices could not cover the production costs for several actors in the supply chain. The situation also led to frequent consultations between farmers’ syndicates and representatives from both the slaughterhouse and retail meat sectors. In addition, policy-supported initiatives developed roadmaps and action plans towards a transparent, differentiated and collaborating pig value chain.

Starting from this evidence, this paper examines the interesting and long-standing issue of analysing the market power exerted in a supply chain using multiple stages of the chain itself. The slaughterhouses are central players in this supply chain as they are the primary purchasers of live animals from farmers, as well as the main suppliers of carcasses to the Belgian retail sector and the food industry. The oligopsonic threat in this sector is a potential issue due to agricultural production that may involve a lack of coordinated production control among pig farmers (the supply side) and a highly concentrated market of pig slaughterhouses due to significant scale economies (the demand side).

Belgium is a small country with a large and highly specialised meat industry, resulting in a high regional concentration of livestock and a large, diverse slaughterhouse sector. However, this type of analysis can be equally informative for several European regions. Similar situations exist in other European regions, such as in Germany (Bayern, Niedersachsen, Nordrhein-Westfalen, Schleswig-Holstein), Denmark, Ireland, eastern Spain, France (Normandy, Bretagne), the west and south of the Netherlands, and the central region of Poland. Belgium’s particular advantage is its limited size, which makes it possible to complement regional data with data that is available on a national level, thus leading to more detailed results.

The remainder of this paper is structured as follows. “Overview of the pig market sector in Belgium” highlights the background of the pork sector in Belgium by looking at some market structural variables. This section indicates the role of the different actors in the value chain and the specific characteristics of the markets between them: the market for live pigs and the market for pig carcasses. Based on this empirical overview of structural characteristics, we derived some initial assumptions that we embody in our market model. “Model approach” describes the construction of the model that reflects the specific market characteristics for live animals and meat products in Belgium. We build a market power model that estimates output and input market frictions without the need to estimate marginal costs. We also consider the extent to which our estimates are sensitive to different model specifications. “Data” provides results and an interpretation of the variables. “Results” concludes.

Overview of the pig market sector in Belgium

The pork value chain can be divided into different stages, from (i) the pig production to (ii) the slaughterhouses and on to (iii) the upstream market or purchasers of pig carcasses. This section discusses several elements that influence the price formation and market power.

The first group in this sector are the pig farmers, responsible for the production of pigs—the supply side of the pig market—and represented by about 4000 entities. Figure 1 shows the number of pig farmers and the number of slaughtered pigs during 2000–2015. The number of pig farmers has been decreasing steadily since 2000. The total stock of pigs has reduced as well but only to a limited extent. In 2008, there were 6553 pig farmers in Belgium, with a total production of more than 6 million pigs. The environmental policy in Belgium has had a clear influence on the total pig population. For example, the pig stock increased again in 2008 as a result of the introduction of the MAP-IIIFootnote 1 (FOD Economie 2015). Between 2000 and 2008, the pig stock in Belgium contracted by 15%, while the number of pig farms decreased by more than 35%. Consequently, the average number of pigs per farm increased from 720 units in 2000 to 1346 in 2015. This trend towards economies of scale has continued for decades (FOD Economie 2010) and the Belgian pig market sector has had difficulties for a number of years. The tendency towards scale increases has led the average pig farm to invest heavily. The debts that are incurred to carry these investments have not yet been recovered, as profits from animal-raising farms have continued to face pressure from decreasing market prices and increasing fodder prices (Deuninck et al. 2009). However, the selling prices of pork production have not followed the same evolution, which has placed downward pressure on the profitability of farmers involved.

The second group of actors is represented by roughly 60 locally present slaughterhouses. In Belgium, all pigs are slaughtered in registered slaughterhouses and the role of slaughterhouses is pivotal in the meat supply chain. Unlike in other countries (Hayenga et al. 2000; Schulze et al. 2006), strong vertical integration in Belgium is uncommon. The slaughterhouse sector in Belgium is highly diverse and has a large number of independent entities. Over the years, this sector has seen also a strong trend towards consolidation. Whereas more than 200 slaughterhouses were active around 1995, about 90 large active sites remained in 2011. Table 1 reports the numbers of active slaughterhouses for pigs, based on official data from the Federal Agency for the Safety of the Food Chain (FAVV). The smallest entities, with fewer than 10 animals per year, were excluded because they are related to artisanal butchers and local actors that rely on a personal supply chain. Also, a number of mixed slaughterhouses are active in the production of both beef and pork. These mixed slaughterhouses are historically related to communal slaughterhouses in rural areas. On the other hand, large industrial slaughterhouses have specialised in pork production. The largest share of the market is occupied by a limited number of these specialised pig slaughterhouses. The Herfindahl-Hirschman index (HHI) (Hirschman 1964) indicates a slow, gradual consolidation of the pig slaughterhouse sector. Over the years, the market share of the specialised pig slaughterhouses has gradually increased.

On the upstream side of the slaughterhouses, the third group consists of the purchasers varying from meat distributors to retailers. For pork, about 140 Belgian companies are active in the meat production and meat processing sector (FOD Economie 2010). The carcasses end up either directly with the butchers or the supermarkets, which then continue to process them, or they go through the entire value chain via the processing industry and then pass through the distribution network to reach the end consumer. The retailers in the meat processing industry are relatively large players with clear bargaining power. In addition, it is difficult for the slaughterhouses to differentiate the supply and the switching costs for the meat purchasers are low. This increases the competitive pressure on the slaughterhouses.

The exchanges between these groups occur on the markets for live pigs and for pig carcasses. Price setting in the market for live pigs is based on the interaction between the slaughterhouses and the individual farmers who present their live animals. In principle, sales of live pigs lead to different prices for each transaction. However, price differences for live pigs have diminished, certainly during the last decade, and the price has become increasingly levelled across the sector. Several trends have contributed to this evolution. First, the various governmental efforts to introduce transparency into the meat production chain have resulted in the largest pig slaughterhouses publishing their purchase prices for live pigs on a weekly basis. Those numbers can be consulted by the pig farmers, allowing them to gain a better understanding of the price movements and tendencies. According to their price setting, slaughterhouses are connected to the European market, where the German price is the target price. Individual farmers negotiate within a small variation of the published price depending on the quality of their animals. VEVA, the cooperation of Belgian pig farmers, collects the weekly net prices that farmers receive after negotiation.

Farmers have organised and formed several farmers’ unions, whose combined membership covers all large pig farmers. These unions are starting up discussions with federations of slaughterhouses and meat retailers to improve the working conditions in the value chain. The unions have also been communicating sales prices among their members in order to improve the negotiation position of the individual farmers. However, there is no coordinated discussion at sector level with the unions on the actual price levels, as this would be collusive behaviour.

Table 3 shows that only a very small percentage of live pig production is transported to foreign slaughterhouses, highlighting the very localised nature of pig sales. Consequently, the market is characterised as one where the bargaining position is relatively more advantageously oriented towards the demand side. From the pig farmers’ perspective, it is difficult to subsume a resistant position vis-à-vis their consumers because a transaction loss would entail a higher relative cost for farmers (and profit losses); in other words, the constant supply of pigs weakens their bargaining position.

Despite their advantages, the slaughterhouses have limited bargaining power. The slaughterhouses stress that negotiations with farmers remain difficult. Past investment in larger industrial pig slaughterhouses brought the slaughterhouse sector close to overcapacity. The slaughterhouses need to make significant efforts to obtain a sufficient number of live animals in order to remain operational at their full capacity.

Secondly, as Table 3 indicates, while few farmers export their live pigs, the option to export remains open. So, if a Belgian slaughterhouse reduces their live pig prices too much, pig farmers will look for foreign opportunities quickly. This interaction with markets in neighbouring countries is also an important influence for price setting. For negotiations of the live pig prices, the price levels of the local market are considered, as well as the published purchase prices in Germany (Schleswig-Holstein) and the Netherlands (FOD Economie 2015).

Table 2 reports the average annual input prices for live pigs. These prices are averaged real prices that have been collected by phone from individual farmers by VEVA. This cooperation of Belgian pig farmers compiles these prices to constitute a factual data source of prices. These real data are also used for the econometric estimations.

The real prices can be compared to the official published prices by slaughterhouses. The comparison shows that slaughterhouses maintain the option to vary sales prices for live pigs within a certain margin on their own published prices. These variations, which are attributed to quality differences of the pigs, clearly indicate that the negotiation and individual market transaction between the individual pig farmer and the slaughterhouse remains the central locus where market powers are potentially exerted. We observe initial high-price variability between 2001 and 2002 as the result of the second BSE crisis, which led to a relative high demand of pork. The subsequent period was characterised as a relatively stable price evolution. In the latter years, 2010–2013, these prices rose again.

On the upstream side of the slaughterhouses, pig carcasses are exchanged with the retailers and meat distributors. Unlike for the market of live animals, sales of pig carcasses take place on an open global market. Most of the produced pork and pig carcasses are intended for export. These tendencies are illustrated in Table 3. A minimal net import of live pigs is present in Belgium (except for 2015). On the other hand, the export of carcasses is very important. More than half of the total pork production in Belgium was destined for export in 2005, and this proportion increased to two-thirds of production in 2015. The market for pig carcasses is fully global. Whereas live pigs can only be transported for limited distance before reaching the processing facility, the processed intermediate products can readily be sold at the international market, which means that sales are directly influenced by the prices on the international markets. Slaughterhouses are obliged to account for international meat prices because of the large proportion of meat products destined for export. On this scale, the specialised pig slaughterhouses are assumed to be price takers on their output market.

Fierce international competition on the meat market keeps global market prices low. This explains why, even though prices for meat products have been stagnating for years in Belgium, the meat processing industry achieves significantly higher margins than the slaughterhouses and the animal-raising farms (FOD Economie 2015).

Model approach

This research starts with the empirical verification of a continued low-price level for live pigs. The first part of the model focuses on the dynamics of this price determination following the methodology originated by Azzam (1996). The price setting in the market for live pigs is based on the interaction between the slaughterhouses and the individual farmers who present their animals, leading to power balances vertically in the value chain. Our method of retrieving the price setting involves a bargaining power indicator that identifies the extent to which these prices are bargained by the farmer or the slaughterhouse. In this paper, the empirical possibility of this model specifies this bargaining parameter in the context of whether there is a gap between a wage that covers all farming costs and a wage that would be fully bargained by the slaughterhouse. The second part of the model entails an extension of a microeconomic version of Hall’s (1988) framework for estimating mark-ups that takes frictions in the intermediate input factor market into account. The model is based on a simplified assumption that the slaughterhouse has vertical market power over pig farmers; however, this yields a method that may be useful to analyse bilateral oligopoly in many situations.

Apart from the main contribution of assessing market power in the supply chain of the pork sector, the paper provides a way to model output and input market frictions without the need to estimate marginal costs, and also considers the extent to which our estimates are sensitive to different model specifications. Most popular approaches in empirical industrial organisations rely on total costs data to calculate market power. Our model is different from the standard models using production function approaches, which involve either specific assumptions on the functional behaviour between inputs and outputs and/or sophisticated econometric techniques to identify the structural parameters of a model (see Amoroso et al. 2015, for a recent overview). In particular, our identification strategy follows a standard assumption in the conduct parameter models that marginal costs are constant with respect to quantity, but may be dependent on other external shift parameters. Conditional on the interest of the analysis, identification of market power can be further disentangled into a conjectural variation and the elasticity of demand.

The overview of the different actors and tendencies allows us to delimit the factors of the market power model. Two different markets are included: (i) the market of live pigs and (ii) the market of pig carcasses. The main focus of this research lies on the dynamics in the live pig market for the exchange of live animals between pig farmers and pig slaughterhouses. Both parties have opportunities to improve their respective market position, so the model should incorporate the measurement of bilateral market power.

Pig farmers coordinate to improve their market position, which can lead to collusive behaviour in the coordination of two strategic variables: price and quantity. The pig farmers’ coordination involves price transparency and information, so the model must account for market power in that sense. However, the large number of pig farmers involved—over 4000 farms—means that collusion by coordination of production quantity is highly unlikely. With so many farms, a coordinated control of the quantity of produced live pigs would leave an overly large incentive for free-riders. The evolution of the production levels also contradicts this assumption. The market position of pig farms would be enhanced if the collusion reduced the total quantity of live pigs. During the last decade, however, pig farms have invested heavily in increasing their individual production capacities and maintained large production levels despite adverse market conditions.

The pig slaughterhouses are in a different position. This group can behave strategically to improve its position on the live pig market. As the specialised pig slaughterhouses have the lion’s share of the market, there is potential for strategic behaviour to control both quantity and price. The model must account for both dynamics.

The second market—the market of pig carcasses—is fully global. Whereas live pigs can only be transported for limited distances before reaching the processing facility, the processed intermediate products can readily be sold in the international market, while means the sales are directly influenced by the prices in the international markets. At this scale, the specialised pig slaughterhouses are assumed to be price-takers in their output market.

Structural market models

The market power estimation follows a structural market analysis approach. There are several approaches to estimate market power, including conduct-performance models, industrial structure analysis or dynamic games (Perloff et al. 2007). A specific strand of industrial structure has used this approach extensively and has been grouped under the name “new empirical industrial organisation” (NEIO) (Bresnahan 1989). The NEIO approach frequently measures market power by estimating conjectural variations (Iwata 1974). The conjectural variation is based on one strategic output of a firm (most often price or quantity) and indicates whether firms regulate their strategic output as a consequence of their competitors’ change in output. When non-negligible interaction is measured, the conjectural variation reveals different types of non-competitive market behaviour, such as collusion or price arrangements between competitors (Appelbaum 1982). The conjectural variation may also be directly linked to a price wedge and to standard price mark-ups, such as the Lerner index. Depending on the range of conjectural variations, different types of collusion or market leadership by a predominant actor may be discovered (Roy et al. 2006). It is not possible to predict the most appropriate type of market distortion. The NEIO approach allows for this freedom and maintains a reasonably simple model structure on the basis of a single parameter per market (Sexton 2000).

The single-sided use of conjectural variation in only the input or output market has been applied frequently in agricultural markets (Myers et al. 2010) and most regularly in the beef-packing industry in the USA (Sheldon and Sperling 2003). Lloyd et al. (2006) used the market shock created by the crisis sparked by the mad cow disease in the UK to investigate market powers in the UK beef market. Applications also looked at mark-ups in Australia (Chung and Griffith 2009) and Ukraine (Perekhozhuk et al. 2011), among others. This single-sided analysis was further refined to account for input substitution (Azzam and Pagoulatos 1990), regional consolidation (Azzam and Schroeter 1991) and relations’ regional and national indications of oligopsony (Perekhozhuk et al. 2015). Whereas these studies mostly looked at the power structure at the sector level, further detailed analysis could use data at the firm level. Therefore, an increasing number of studies have combined the effect of market power and firm efficiency (Delis and Tsionas 2009; Kutlu and Sickles 2012; Lopez et al. 2002).

The double-sided investigation of input and output markets, which leads to approximations of oligopolic and oligopsonic behaviours, is equally possible. Schroeter (1988) set up the first application of both mark-ups in output and mark-downs in input markets to investigate the evolution of market powers in the US beef-packing industry. Other applications showed the evolution of both mark-ups and mark-downs in the US pulp and paper industry (Mei and Sun 2008). In France, an important study uncovered significant market powers in the retail of dairy and meat products (Gohin and Guyomard 2000). Yanaura and Xia (2016) looked at bilateral market power between US-Japan importers and exporters of agricultural commodities. Additionally, a link between welfare loss and imperfect markets was established (Mérel 2011). Further elaboration of the models led to methods of quantifying imperfect price transmission between different actors in the value chain, both in theory (McCorriston et al. 2001; Weldegebriel 2004) and in practice (Gonzales et al. 2002).

Because the model is based on the single parameter of conjectural variation, Morrison Paul (2001) called for caution when interpreting the results because other effects that are not related to active market collusion, such as large efficiency differences in the sector or missing inputs, can also influence this single parameter. Other criticisms of this approach indicate that the results of these models provide only modest departures from perfect competition and that it is difficult to define the figures precisely. However, this notion is also related to the limited availability of precise data to which the early NEIO models were applied (Myers et al. 2010). In each case, the results are useful starting points for more detailed analyses that have subsequently modelled a specific market configuration.

The situation of the pig farmers

In this case, the market between farmers and processors must account for the possibility of oligopolistic behaviour of farmers as well as oligopsonic behaviour of processors. Thus, there is potential for bilateral bargaining powers, where collusive behaviour on the supply side can be compensated for by similar behaviour on the demand side. This type of analysis was first proposed by Azzam (1996) and has been applied to the Danish pork production chain (Jensen 2009) and to optimising marketing for food retailing (Chung et al. 2014). Kinoshita et al. (2006) extended this method to be applied over several levels of the Japanese dairy production chain. Our model builds on these projects and incorporates the particular value chain characteristics, as described in “Overview of the pig market sector in Belgium”.

For the market of live pigs, we must include the balance of market power between farmers and slaughterhouses. In this case, a bilateral oligopoly-oligopsony should be considered, leading to power balances vertically in the value chain. Following Azzam (1996), the final price of farm live pigs pF is defined by:

Here, α is the indicator for the vertical market power of the farm cooperatives. pF is determined as a weighted average between \( {p}_F^{\mathrm{Upper}} \) and \( {p}_F^{\mathrm{Lower}} \). \( {p}_F^{\mathrm{Upper}} \) is the highest price the farmers could obtain if they were the price-setters in this market. This price is determined based on the cost structure of the pig farmers. \( {p}_F^{\mathrm{Lower}} \) is the lowest price the pig slaughterhouses could obtain for their input if they were the sole price-setters. This price is determined by the production and cost structure of the slaughterhouses.

On the farmers’ side, the profit πi of an individual farm i can be expressed as:

where pF is the unit price for the farm product (live pigs), qi is the produced quantity by farm i and CF(Vi) is the production cost dependent on a vector of inputs Vi. When the farmers strategically optimise their quantity of production, the first-order condition yields the following equation:

where MCF is the marginal production cost at the farm, msFi is the market share of farm i, εSFi is the price elasticity of supply and ηFi is the conduct parameter. This conduct parameter is originally defined as a conjectural variation (CV). This CV explicitly captures the strategic disposition of the farms to adapt their production quantity to the quantity produced by all other farms and thus measures collusive behaviour. The literature has an increasing tendency to interpret this as a general market power parameter with range \( \left[0,\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{${ms}_{Fi}$}\right.\right] \) (Sexton et al. 2007). When the market parameter is 0, the price equals marginal costs, and the situation reflects perfect competition. At the maximum, the price reflects a collusive cooperation as a monopoly. In this context, it is especially relevant that the market power indicator μFi in Eq. (4) reflects the effect of horizontal market power; that is, the collusive behaviour between farmers. This is less likely in the case of the pig farmers. Therefore, it is assumed that μFi equals unity for the case of the pig farmers. This assumption is also possible following the definition of the marginal costs estimation.

Identification

The preferred solution is to approximate the different cost functions of the actors directly. Following Sexton et al. (2007) and Kinoshita et al. (2006), we assume linear marginal cost functions for the farms. These marginal costs are influenced by price fluctuations of factor inputs, leading to:

Here, wFi are price indexes for i∈ (land, capital, labour, feedstock). This approximation can be done based on individual farm-level data available from the European Farm Accountancy Data Network (FADN).

Based on Eqs. (1) and (4), it is possible to construct \( \hat{p_F^L} \) and thus an estimation for \( {p}_F^{\mathrm{Lower}} \). Yanaura and Xia (2016) used a function of various factors, \( \hat{p_F^L}\equiv \gamma^{\prime}\theta \), to represent the degree of dominance of US exporters in the price setting of soy beans, where θ is a vector of commodity substitute prices and γ′ is a vector of parameters to be estimated. We follow their approach. Assuming a continuous distribution of margins in the upper part of the pork value chain, it is possible to approximate the evolution of \( {p}_F^{\mathrm{Lower}}\approx \hat{p_F^L} \), being the lower negotiation value offered by slaughterhouses, by following the Consumption Price Index for pork Ip, which is compiled by the Belgian Statistics Office within the data gathering effort to determine the total inflation in Belgium on a monthly basis. The index is based on measured prices of a variety of pork products at the consumer level and provides an objective and useful indication of the average price variation of all products derived from pig meat at the end of the value chain.

The prices are estimated as follows:

and β is a parameter to be estimated. Equation (1) becomes:

Equation (4) provides the basis for the price setting. The marginal costs that measure the upper limit of the live pigs, \( {p}_F^{\mathrm{Upper}} \), define the bargaining position of pig farmers. These marginal costs define the negotiation starting point for the pig farmers. The functional form in Eq. (7) can guarantee that α ∈ [0, 1] but impose no sign constraints on the parameter α. α = 0 indicates complete dominance of slaughterhouses in their bargaining position and α = 1 indicates a complete dominance of pig farmers in the price setting. When α < 0.5 (α > 0.5), slaughterhouses have more (less) market power than pig farmers.

In Eq. (5), the labour cost component denoted by cFlwFl contains two components. The first component is paid labour, which is reported in the farming balance sheet as a result of salaried work. The second component relates to unpaid labour, which is self-income to the farmer. This unpaid labour is usually calculated based on ex post market prices, whereby wages are determined endogenously: once the market prices are determined, we can solve for wages. This ex post calculation of wages is usually set to a level that absorbs profits, which has implications on the interpretation of the bargaining power, shown by Eq. (7). The alternative is to use an exogenous wage (see “Data”). In this paper, we set the unpaid labour valued according to the average gross hourly salary for artisanal labourers in Belgium. This implies that the requested remuneration is supposed to cover all costs, including financing of land and a full wage based on the artisanal labourer’s salaries. As a test for robustness, we also calculated the self-income on the basis of a minimum wage. The gross hourly minimum wage (CPI adjusted) is calculated based on the official yearly determined minimum wage in Belgium divided by the official working hours set by the government. In both instances, vertical market power—as measured by α with a value less than 1 (100%)—implies that a pig farmer does not receive a (modest) full-wage-based salary.

The determined marginal costs allow Eq. (7) to be estimated.

where λ ≡ (1 − α)β and νt is the error term. The estimated parameters \( \hat{\alpha} \) and \( \hat{\lambda} \) are used to interpret the relative dominance of farmers versus slaughterhouses in terms of market power. The link between the pork price index and the negotiation objective of the slaughterhouses, \( \hat{\beta} \), can be derived from \( \hat{\lambda} \), that is, \( \hat{\beta}=\hat{\lambda}/\left(1-\hat{\alpha}\right) \).

The situation of the pig slaughterhouses

The second part is the situation of the processors, or the pig slaughterhouses. In particular, we let each firm j ∈{1, …N} face the following production function:

where Yj measures firm j’s gross output, Xj ≡ (Xj1t, Xj2t, …, XjLt) denotes the vector of L non-negative factor inputs (capital, labor,…), Fj(.) is the core of the (differentiable) production function and Aj is the total factor productivity (TFP) measured as the rate of a Hicks-neutral disembodied technology. The logarithmic differentiation of production function (9) yields:

with \( \frac{dY_j}{Y_{jt}} \) (logarithmic) output growth and \( \frac{dA_{jt}}{A_{jt}} \) (logarithmic) TFP growth. It is assumed that each firm j faces an inverse demand function, pj(Y, Z), which represents the market price as a function of aggregate (industry) output \( Y\equiv {\sum}_{j=1}^J{Y}_j \). That is, by specifying firm j’s (output) price as an arbitrary function of aggregate output, we allow for various potential degrees of firm j’s market power, and Z as the vector of demand-related variables (here we need to specify, for instance, the world price as well as other market demand-related variables).

Firm j’s optimisation problem can be written as:

where Wj ≡ (Vj1, Vj2, …, VjL) is firm j’s vector of Lj input prices, and \( {p}_F^{\mathrm{Lower}}\left(Y,Z\right) \) is the lowest price the pig slaughterhouses could obtain for their input of live pigs if they were the price-setters in that market.

Assuming in the first instance that there is imperfect competition in the input market and perfect competition in the output markets (an oligopolistic firm acting as a price-setter in its input market and a price-taker in its output markets), the first-order conditions (FOCs) implied by the solution of (11) yield the following equations for the Lagrange multiplier and the nominal input prices:

where, according to Diewert and Fox (2008), the Lagrange multiplier \( {p}_j^{\ast } \) is firm j’s shadow or marginal price of output under profit maximisation, \( {ms}_j=\frac{Y_j}{Y_t} \) is the market share of firm j, \( {\varepsilon}_{jF}\equiv -\frac{\partial Y}{\partial {p}_F^{\mathrm{Lower}}\left(Y,Z\right)}\frac{p_F^{\mathrm{Lower}}\left(Y,Z\right)}{Y} \) is the (absolute value of) elasticity of supply in the input market and \( \vartheta =\frac{\partial Y}{\partial {Y}_j} \) is the conduct parameter. The solution to the profit maximisation as shown in Eq. (12) can be rewritten as:

where the term between square brackets is firm j’s mark-up in the input market. Note that, in the case of perfect competition, \( \frac{\partial {p}_F\left(Y,Z\right)}{\partial Y} \) goes to zero, implying that prices are set at marginal cost and inputs are paid their marginal products (with mark-up equal to 1).

An approach for measuring market power is to measure the conduct parameter ϑj instead of using the Lerner index (Bresnahan 1989; Corts 1999). As in Kutlu and Sickles (2012), the definition of MC follows from Eq. (14) when inputs are paid their marginal products:

where εjF ≈ εF is the elasticity of aggregate input supply.

Identification

Following Kutlu and Sickles (2012), we may rewrite Eq. (15) as

where \( \mu =1-\frac{ms_j}{\varepsilon_{jF}}\ {\vartheta}_j>0 \) is the market-share-weighted profit margin on the output market and is bound between \( \left[0,\left(1-\frac{ms_j}{\varepsilon_{jF}}\right)\right] \), while νj makes the function stochastic.

Following Corts (1999) and Kutlu and Sickles (2012), we can rearrange the expression \( \mu (.)=1-\frac{ms_j}{\varepsilon_{jF}}\ {\vartheta}_j \) so that an average conduct parameter can be obtained by the following expression:

where ^ refers to the estimate of the corresponding variable. In this sense, the conduct parameter ϑjt can now be interpreted in terms of an elasticity as well as market power. Note that the aggregate demand parameter \( {\hat{\varepsilon}}_F \) can be derived from estimating a demand function, market share msj is fully observed while market power \( \hat{\mu} \) can be extracted from an estimated supply function (Bresnahan 1989; Corts 1999; Kutlu and Sickles 2012). Following Bresnahan (1982), Lau (1982), Corts (1999), and Perloff and Shen (2012), the need to estimate marginal cost function requiring total cost data can be circumvented by assuming that MCj are constant; this means that they do not depend on Yj but may be a function of cost shifters. Given this assumption, Eq. (13) suggests that if MCj and Yj are (highly) collinear, MC may be identified through the variation in \( \frac{\partial {p}_F\left(Y,Z\right)}{\partial Y} \).

Data

The model utilises data at the consecutive points along the pork value chain. First, farm-level data are required to estimate the marginal production costs for pig farmers. Secondly, market data are necessary for the market of live pigs. Finally, agent-level data are also required for the slaughterhouses. These data cover both individual quantities and financial variables.

The situation of the pig farmers

The farm-level data is based on Flemish Farm Accounting Data Network (FADN). We consider data on specialised Belgian pig farmers. For this application, farms were considered specialised when at least 75% of their total income was based on the production of pigs. This leads to an unbalanced panel data set of 764 observations, covering the years 2001 to 2013.

The included marginal costs are inputs for labour, land, capital and feedstock. Land is considered as a separate factor of production. Marginal land costs for owned land are based on the value of the lands reported in the balances and on the average interest rates for long-term deposits. This cost represents forgone income on capital interests that are lost when investing the capital in land rather than in deposits and is based on the average long-term revenue on deposits in Belgium. Capital inputs are maintenance of machinery-related capital and building capital as well as depreciation of capital assets based on the replacement value, and interest and financial charges paid. The feed costs include feed for pigs and poultry, as well as veterinary fees and reproduction costs.

The approximation of the wage costs for production cannot be based on the reported farm family income (FFI), which is calculated by looking at the net revenues of the farm over the year, and therefore already incorporates the market side of the equation. This would also imply that wages vary with the market prices of live pigs, assuming that the farmers accept any kind of wage following market prices. In this case, a wage independent of market dynamics has been integrated. Paid labour on the farm is accounted for in the reported balance sheets. Unpaid labour is provided by the farm family and the upper negotiation objective of the farms includes full wages for every participating household member. For this approach, the cost of the labour input includes reported unpaid labour hours, which are valued according to the average gross hourly salary for artisanal labourers in Belgium.

These marginal costs define the negotiation starting point for the pig farmers. This implies that the requested remuneration is expected to cover all costs, including financing of land, and a full wage based on the artisanal labourers’ salaries. These wages are relatively low—only wages for unschooled labourers are lower, and wages for factory workers are slightly higher. But this also means that the starting position does not request wages for company executives or independent workers, even if, in reality, the farmers are independent company leaders.

Table 4 shows the calculated marginal costs for each of the input factors over the period 2001–2013. The total marginal costs denoted by MCF(Vi) are equal to the sum of each of the input factor values (capital, labour, land and feed), which are also shown in Table 4. Feed costs comprise the largest cost component and have increased over time, while land can be considered as a relatively low-cost component. Capital and labour costs represent approximately 25% of the total costs. It is also important to note that while capital costs remain stable over time, labour input decreased by almost 50% from 2001 to 2013.

The situation of the slaughterhouses

For the situation of slaughterhouses, a unique database of panel data on different types of information was assembled. The final panel data set contains 240 observations between 2001 and 2015, with combined slaughter data and financial data on 28 slaughterhouses. The slaughter data is based on slaughter statistics from the Belgian Food Security Agency (FAVV). Financial data is based on the official annual balances deposited at the National Bank. This database includes most of the sector’s activity in Belgium. In this study, only the specialised pig slaughterhouses are considered. We excluded specialised cattle, mixed slaughterhouses for cattle and pigs, and specialised poultry slaughterhouses from the scope of this study. Table 5 reports the mean and standard deviations, as well as the first and third quartiles of the included data for our main variables in Eq. (17). In particular, the table presents slaughterhouse-level data on output prices, marginal costs and market shares, as well as the input lowest price for pig slaughterhouses captured by the pork price consumption index.

Results

The results for the estimations of the pig farmers’ situation using Eq. (8) are reported in Table 6 using robust ordinary least squares.Footnote 2 The parameters \( \hat{\alpha} \) and \( \hat{\lambda} \) of Eq. (8) are used to interpret the relative dominance of farmers versus slaughterhouses in terms of market power. The link between the pork price index and the negotiation objective of the slaughterhouses, \( \hat{\beta} \), can be derived from \( \hat{\lambda} \). The results, using a robust ordinary least squares regression, indicate a level of \( \hat{\alpha} \) equal to 75.0%***. This shows a power balance that offers a significant advantage to the pig farmers relatively to the slaughterhouses in setting the unit price pF. In absolute values, \( \hat{\alpha} \) = 75.0%*** remains pessimistic from the farmer’s perspective. As mentioned earlier, the weight \( \hat{\alpha} \) is set to a reference point of the farmer receiving an income that covers operating costs, including a workers’ wage for himself or herself. This is a quite minimalistic starting position for the farmer. On the basis of this reference point, the market does not allow the farmer to receive this income, but less. Consequently, farmers need to adopt a cost-minimising strategy and aim to fully optimise their production capacity at all times. However, in a market where utilisation ratios show an over-capacity in the sector and low prices, this could have detrimental effects such as lower incentives for farmers to invest. Investments are crucial in the sector because they enable farmers to obtain the best possible valorisation of their animals. Furthermore, the ongoing trend of more horizontal coordination can even strengthen their bargaining position and thus foster more competition, given that pig price class settings are uniformly regulated by the European Commission.

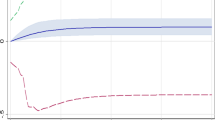

Figure 2 shows the evolution of three different prices in the live pig market between 2001 and 2013.Footnote 3 The data comes from Tables 2, 4 and 7, where we consider the live pig price, prices set at their marginal costs and the slaughterhouse price objective. The slaughterhouse price objective is calculated using Eq. (7) using the estimated values for the market power parameters \( \hat{\alpha} \) and \( \hat{\lambda} \) and shows that the final price for live pigs follows the evolution of the marginal costs. It should be kept in mind that these marginal costs are determined based on a relatively modest wage expectation. Between 2004 and 2006, the revenues were slightly higher than this reference, indicating that the farmers were able to obtain a relatively higher wage during these years as well. All other years this wage could not be obtained. The evolution of the slaughterhouse price objective throughout the years remains well below the pig market price, meaning that market power at the slaughter input market remains throughout the period. The oligopsonic market structure can play an important role and this pricing strategy can also be accomplished by a slaughterhouse having a constant, guaranteed supply of living pigs. In addition, local slaughterhouses can also adjust prices, despite having Germany has a price-setter on the Northwest European market. There is a logical correlation between the slaughter weight and the price: if demand exceeds supply, there will be more demand and the average weight will fall but prices will increase. On the contrary, if supply exceeds demand, the average weight will increase and prices will fall. Slaughterhouses can restore a price equilibrium on the market by postponing production. This has two effects. First, it puts extra pressure on pig farmers, which is advantageous for the bargaining position of the slaughterhouses. A second effect is that lower meat production yields towards a supply scarcity, which puts upward pressure on the selling prices of processed pig meat. Of course, on a long-term basis, prices of living pigs are not only influenced by demand and supply, but also by feeding costs and technological progress in the sector.

As a test of robustness, we also re-estimated an \( \hat{\alpha} \) calculated on the basis of an hourly wage equal to a minimum wage. The estimation results are also shown in Table 6. We obtained an alpha equal to 0.78%**. In line with expectations, the alpha increased slightly and can be easily explained by the fact that if costs decrease—or, more specifically, if farmers lower their compensation demand from their operation costs from the slaughterhouses—this increases their bargaining power, yielding a higher alpha. Because alpha is still below 1 and significant, the robust results validate our assumption of haven chosen an artisanal wage.

Table 8 reports the average market shares, mark-ups and the conduct parameters in the slaughterhouse sector by estimating Eq. (17) yearly. Given an estimate for the mark-up, we then calculate the conduct parameter, as shown by Eq. (18). Concerning the situation of the slaugherhouse output market (using Eq. 17), one can see a stable market configuration: the overall \( \hat{\mu} \), for the period 2001–2015 equals 1.175%*** (standard error, 0.14%). The results per year of these estimations are also reported. These profit margins remain very low throughout the years. Since 2004, average market share has increased steadily, indicating the slow consolidation of the slaugtherhouse sector. However, the conduct parameter has decreased during the same period, as collusive behaviour and strategic adaptation of production quantities seem to have become less attractive.

However, there are significant differences among the market power indicators of the different slaughterhouses. The same estimation can be made for each slaughterhouse, assuming the conduct parameters for each slaughterhouse are constant during the considered time period. In that case, Eq. (17) can be estimated using a non-linear least squares regression. Table 9 shows the results of the estimations of Eq. (17) when grouped by slaughterhouses over the different available years. The \( \hat{\mu} \) varies between − 0.96 and 3.95%, and no direct link exists with the average market share of these slaughterhouses. This reflects a diversity of strategies within the sector. Some slaughterhouses opt for large turnover with slim margins and reduced mark-ups (for example, slaughterhouse 11). Other slaugherhouses target very small markets with high-value products (for example, slaughterhouse 25). This diversity of strategy again reduces the possibility of collusive behaviour in the entire sector.

Conclusions

This model concentrates on the interaction between pig farmers and slaughterhouses. Integrating these factors in a consistent model requires detailed description of the potential decisions for each actor. This work is based on related models for agro-industrial food chains. Over the years, these experiences have enabled the application of a structural modelling approach to a wide range of different market types. The review of the sector shows that market power can potentially be exerted by different actors. This market power can take different forms. Pig farmers can obtain improved market positions by coordinating their price negotiations for the live animals. Slaughterhouses can coordinate both price and quantity but are constrained by the fact that their output is sold on a global market, where they are essentially price-takers.

The results indicate that the pig farmers face significant market pressure from the slaughterhouses, which results in low sales prices for pigs. Consequently, the income from pig sales do not cover all of the marginal costs, including a standard worker’s wage for the farmer.

Significant market power does not lead to strongly increased profitability for the slaughterhouses. The slaughterhouses are subjected to severe market pressure in their output market due to low carcass prices and international competition. This is reflected in the low mark-ups that the slaughterhouses can charge on their products. As a result, the companies adopt a range of coping strategies, moving from growth towards high-volume and low-margin products, or, in the opposite direction, an evolution towards high-value products with increasing vertical integration.

Both for pig farmers and slaughterhouses, economic conditions remain difficult. Moreover, even if there is significant market power exerted on the pig farmers, the slaughterhouses merely transmit this market power from higher up in the value chain. The first part of the pork value chain is subjected to this pressure together.

Further research can shed light on the reasons behind this development. A first reason can be low international prices for pig carcasses, which do not reflect the production standards in Belgium. The high marginal costs for the production of live pigs in Belgium include strong environmental restrictions, animal well-being investments and also need to cover at least a worker’s wage, according to the Belgian minimal standards. Worker’s wages and environmental standards can be considerably lower in foreign pig farms. A comparison between these costs and production efficiency may provide a better view on the international competitiveness of Belgian pig production.

A second reason may also be related to the recent development of scale increases, both for the pig farms and for the slaughterhouses. Continuous low output prices can also indicate a situation of structural overproduction of the sector. This would imply that the low output prices are a consequence of the excessive production of pigs and pig carcasses, and that the evolution of the sector’s production capacity does not adapt accordingly. Further research into the time series of production capacities and prices could indicate whether this factor is present in Belgium or not.

Change history

12 December 2019

The article “Investigating market power in the Belgian pork production chain”, written by Dries Maes, Mark Vancauteren and Steven Van Passel, was originally published electronically on the publisher’s internet portal (currently SpringerLink) on 27 November 2019 without open access.

Notes

MAP-III is an action programme of the European Nitrates Directive (91/679/EEG), which is a guide to the Manure Policy in Flanders.

We also considered some robustness checks in the estimations. Whereas the generalised or weighted least squares is more efficient than OLS under heteroscedasticity or autocorrelation, it is worth investigating these alternative results. We also consider the weighted least squares (WLS) using 1/(StDev)^2 as weights given more observations with larger noise less weight in the results. For the estimation (using time series) to determine the alpha (see Eq. 8), we considered first testing the variables for stationarity using the Dickey-Fuller generalised least squares (DFGLS). We could marginally reject the presence of a unit root in the MC variable (at 5% but not 10%); that is, for the marginal costs. We therefore transformed Eq. (8) in first differences, yielding an alpha that is equal to 0.801**. Concerning the estimation using Eq. (17), we have considered a GLS allowing the data to be heteroscedastic. The difference in coefficients that followed from Table 5 was no more than 0.05 percentage points; this validates the robustness of our results.

References

Amoroso, S., Kort P., Melenberg, B, Plasmans J and M. Vancauteren (2015), Productivity, price- and wage-markups: an empirical analysis of the Dutch manufacturing industry. Munich, CESifo Working Papers 5273.

Appelbaum, E. (1982). The estimation of the degree of oligopoly power. Journal of Econometrics, 19(2–3), 287–299.

Azzam, A. M. (1996). Estimating the degree of dominance in a bilateral oligopoly. Applied Economics Letters, 3(4), 209–211.

Azzam, A., & Pagoulatos, E. (1990). Testing oligopolistic and oligopsonistic behaviour: an application to the US meat-packing industry. Journal of Agricultural Economics, 41(3), 362–370.

Azzam, A. M., & Schroeter, J. R. (1991). Implications of increased regional concentration and oligopsonistic coordination in the beef packing industry. Western Journal of Agricultural Economics, 16(2), 374–381.

Bresnahan, T. F. (1982). The oligopoly solution concept is identified. Economics Letters, 10(1), 87–92.

Bresnahan, T. F. (1989). Empirical studies of industries with market power. Handbook of industrial organization, 2, 1011–1057.

Chung, K. C., & Griffith, G. R. (2009). Another look at market power in the Australian fresh meat industries. Australasian Agribusiness Review, 17, 218–234.

Chung, C., Eom, Y. S., & Yang, B. W. (2014). Optimal generic advertising under bilateral imperfect competition between processors and retailers. Agribusiness, 30(4), 438–455.

Corts, K. S. (1999). Conduct parameters and the measurement of market power. Journal of Econometrics, 88(2), 227–250.

Delis, M. D., & Tsionas, E. G. (2009). The joint estimation of bank-level market power and efficiency. Journal of Banking and Finance, 33(10), 1842–1850.

Deuninck, J., J. D’Hooghe, and A. Oeyen (2009), Technische en economische resultaten van de varkenshouderij op basis van het Landbouwmonitoringsnetwerk, boekjaren 2006–2008. Vlaamse Overheid, Departement Landbouw en Visserij, afdeling Monitoring en Studie Brussels.

Diewert, W. E., & Fox, K. J. (2008). On the estimation of returns to scale, technical progress and monopolistic markups. Journal of Econometrics, 145, 174–193.

FOD Economie (2009), Analyse van de kosten en prijzen in de verschillende schakels van het productieproces van rundvlees. FOD Economie, K.M.O, Middenstand en Energie, Algemene Directie Statistiek en Economische Informatie (ADSEI): Brussels.

FOD Economie (2010), Prijzen, kosten en rendabiliteit in de varkenskolom. FOD Economie, K.M.O, Middenstand en Energie, Algemene Directie Statistiek en Economische Informatie (ADSEI): Brussels.

FOD Economie (2015), Actualisatie van de studie over de varkenskolom Prijzenobservatorium.

Gohin, A., & Guyomard, H. (2000). Measuring market power for food retail activities: French evidence. Journal of Agricultural Economics, 51(2), 181–195.

Gonzales, F., Guillotreau P., and Le Grel L. (2002), The transmission of price variability along the French cod value chain in XIVth EAFE Conference Proceedings.

Hall, R. (1988). The relation between price and marginal cost in U.S. industry. Journal of Political Economy, 96(5), 921–947.

Hayenga, M., Schroeder, T., Lawrence, J., Hayes, D., Vukina, T., Ward, C., and W. Purcell (2000), Meat packer vertical integration and contract linkages in the beef and pork industries: an economic perspective. American Meat Institute.

Hirschman, A. O. (1964). The paternity of an index. American Economic Review, 54(5), 761.

Iwata, G. (1974), Measurement of conjectural variations in oligopoly. Econometrica: Journal of the Econometric Society, p. 947–966.

Jensen, J. D. (2009). Market power behaviour in the Danish food marketing chain. Journal on Chain and Network Science, 9(1), 43–58.

Kinoshita, J., Suzuki, N., & Kaiser, H. M. (2006). The degree of vertical and horizontal competition among dairy cooperatives, processors and retailers in Japanese milk markets. Journal of the Faculty of Agriculture of Kyushu University, 51(1), 157.

Kutlu, L., & Sickles, R. C. (2012). Estimation of market power in the presence of firm level inefficiencies. Journal of Econometrics, 168(1), 141–155.

Lau, L. J. (1982). On identifying the degree of competitiveness from industry price and output data. Economics Letters, 10(1), 93–99.

Lloyd, T. A., McCorriston, S., Morgan, C. W., & Rayner, A. J. (2006). Food scares, market power and price transmission: the UK BSE crisis. European Review of Agricultural Economics, 33(2), 119–147.

Lopez, R., Azzam, A., & Lirón-España, C. (2002). Market power and/or efficiency: a structural approach. Review of Industrial Organization, 20(2), 115–126.

McCorriston, S., Morgan, C., & Rayner, A. (2001). Price transmission: the interaction between market power and returns to scale. European Review of Agricultural Economics, 28(2), 143–159.

Mei, B., & Sun, C. (2008). Assessing time-varying oligopoly and oligopsony power in the US paper industry. Journal of Agricultural and Applied Economics, 40(3), 929–939.

Mérel, P. (2011). Institutional market power in Comté: insights from a ‘double marginalisation’ model. Journal of Agricultural Economics, 62(3), 585–603.

Morrison Paul, C. J. (2001). Market and cost structure in the U.S. beef packing industry: a plant-level analysis. American Journal of Agricultural Economics, 83(1), 64.

Myers, R. J., Sexton, R. J., & Tomek, W. G. (2010). A century of research on agricultural markets. American Journal of Agricultural Economics, 92(2), 376–403.

Perekhozhuk, O., Matyukha, A., & Glauben, T. (2011). Estimating the degree of buyers’ market power: evidence from the Ukrainian meat processing industry, in 2011 International Congress, August 30–September 2, 2011. Zurich: European Association of Agricultural Economists.

Perekhozhuk, O., Glauben, T., Teuber, R., & Grings, M. (2015). Regional-level analysis of oligopsony power in the Ukrainian dairy industry. Canadian Journal of Agricultural Economics/Revue canadienne d’agroeconomie, 63(1), 43–57.

Perloff, J. M., & Shen, E. Z. (2012). Collinearity in linear structural models of market power. Review of Industrial Organization, 40(2), 131–138.

Perloff, J. M., Karp, L., & Golan, A. (2007). Estimating market power and strategies. Cambridge: Cambridge University Press.

Roy, A., Kim, N., & Raju, J. S. (2006). Assessing new empirical industrial organization (NEIO) methods: the cases of five industries. International Journal of Research in Marketing, 23(4), 369–383.

Schroeter, J. R. (1988). Estimating the degree of market power in the beef packing industry. The Review of Economics and Statistics, 70(1), 158–162.

Schulze, B., Spiller, A., & Theuvsen, L. (2006). Is more vertical integration the future of food supply chains? Empirical evidence and theoretical considerations from German pork production. In J. Bijman et al. (Eds.), International agri-food chains and networks: management and organization (pp. 49–63). Wageningen: Wageningen Academic Publishers.

Sexton, R. J. (2000). Industrialization and consolidation in the US food sector: implications for competition and welfare. American Journal of Agricultural Economics, 82(5), 1087–1104.

Sexton, R. J., Sheldon, I., McCorriston, S., & Wang, H. (2007). Agricultural trade liberalization and economic development: the role of downstream market power. Agricultural Economics, 36(2), 253–270.

Sheldon, I., & Sperling, R. (2003). Estimating the extent of imperfect competition in the food industry: what have we learned? Journal of Agricultural Economics, 54(1), 89–109.

Van Hecke, E. (2001). Measuring poverty among farmers in Belgium. Belgeo, 2001., 2001(3), 247–262.

Vrints, G., and Deuninck J. (2013), Technische en economische resultaten van de varkenshouderij op basis van het Landbouwmonitoringsnetwerk. Boekjaren 2010–2012. Vlaamse Overheid, Departement Landbouw en Visserij, afdeling Monitoring en Studie Brussels.

Weldegebriel, H. T. (2004). Imperfect price transmission: is market power really to blame? Journal of Agricultural Economics, 55(1), 101–114.

Yanaura, K., & Xia, T. (2016). Measuring bilateral market power in international markets of vertically differentiated agricultural commodities. Journal of Agricultural and Food Industrial Organization, 14(1), 1–10.

Acknowledgements

This research has been made possible with the assistance, information and guidance of several administrations and organisations. We are much indebted to Mr. Robijns and Ms. Kestens from the Federal Agency for Safety of the Food Chain (FAVV), Mr. Seynaeve and the team of Carcass classification of the Ghent University, Mr. Pattyn and Mr. Ingelbrecht from the National Price Observatorium and Ms. Vandenberghe from VEVA, the cooperation of Pig farmers. This article reflects the position of the authors alone, and is not indicative of the position of the Flemish Government. All remaining errors are the sole responsibility of the authors. We thank participants of the EAAE conference held in Parma (August 2017), the 149th EAAE Workshop on vertical food chains held at INRA in Rennes (October 2017) and the JRSS day held in Nantes (December 2018) for fruitful discussions.

Funding

This project has been financed by the interuniversitary fund tuL - Impuls (transnational university Limburg). This research was also partly performed within the frame of the HORIZON 2020 project SUFISA with the grant agreement number 635577 BB CY License text.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The article “Investigating market power in the Belgian pork production chain”, written by Dries Maes, Mark Vancauteren and Steven Van Passel, was originally published electronically on the publisher’s internet portal (currently SpringerLink) on 27 November 2019 without open access. The original article was corrected.

With the Society’s decision to grant Open Access the copyright of the article changed in December 2019 to © The Author(s) 2019 and the article is forthwith distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, duplication, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Maes, D., Vancauteren, M. & Van Passel, S. Investigating market power in the Belgian pork production chain. Rev Agric Food Environ Stud 100, 93–117 (2019). https://doi.org/10.1007/s41130-019-00096-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41130-019-00096-6